If you’re self-employed and you’d like to use your income from this job as the income for your Upstart loan request, we can help!

Unlike a salary or hourly job, we ask that you provide us with your pretax income (revenue minus operating expenses) plus qualifying add backs which we will use in making our approval decision.

Please note that if your income type does not fit into one of the specific categories listed below that we encourage you to reach out to get additional help.

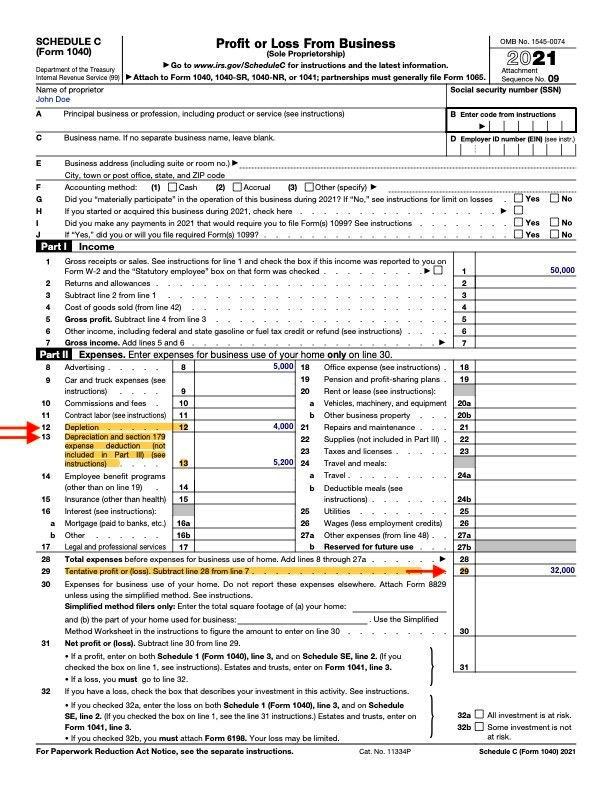

Independent Contractor or Sole Proprietor Income

Upstart recognizes independent contractor and sole proprietorship income by verifying your net profit or loss plus adding any depletion and depreciation.

Been on this job for less than a full calendar year? Use the income present on your contract. No need to review your tax returns.

If you’ve been on this job for > 1 full calendar year, we may need your complete tax return from the most recent full tax year (Ex: 2021 tax return as of the 2022 tax deadline or 2020 tax return with proof of extension)

- Calculation for Independent Contractor or Sole Proprietor Income

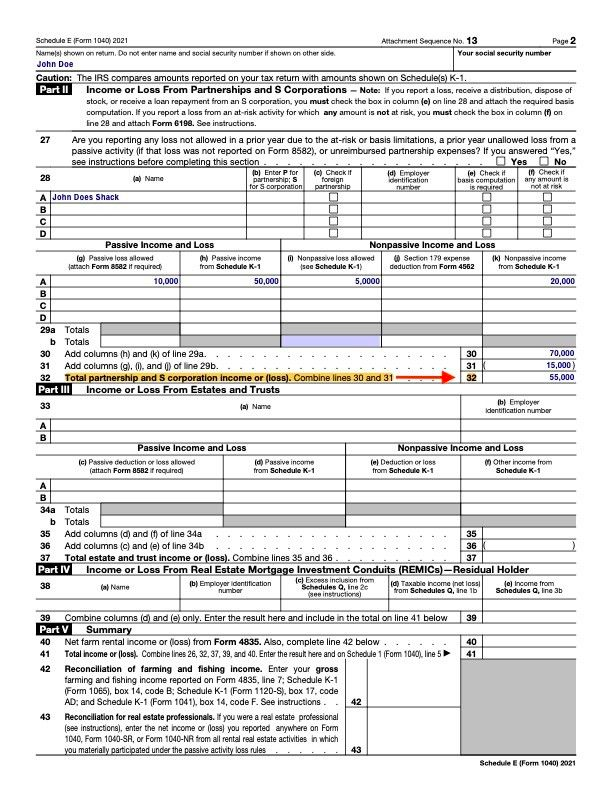

Partnership/LLC or S-Corporation

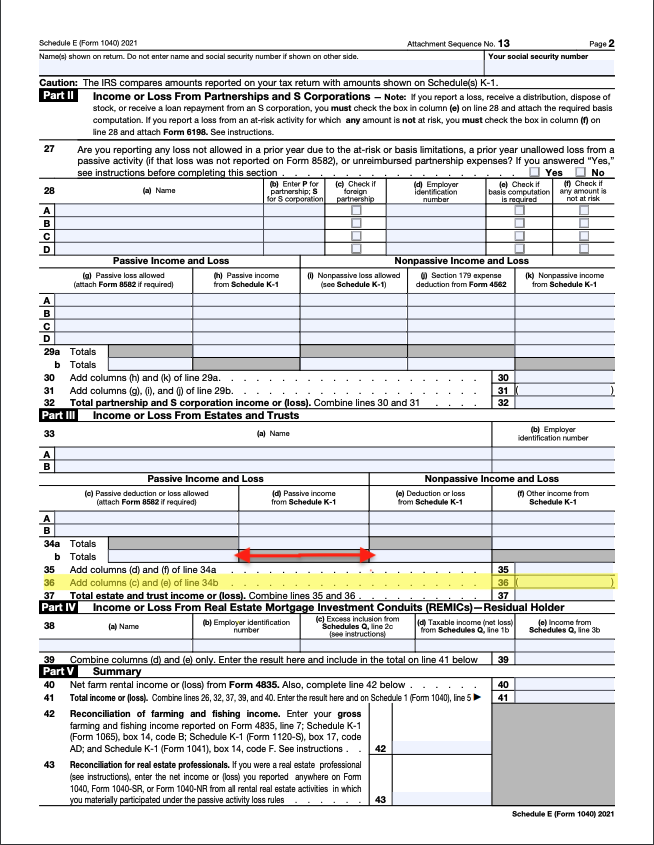

Partnerships and S-Corporations are legal entities that should be on record with the Secretary of State for the state where your company is registered. If your tax return is filed individually we will utilize your page 2 of your schedule E. We will only consider the income from businesses listed in rows A-D that correspond with what was reported on your application. If you filed a joint tax return (both names are present on the Schedule E), we will need your specific K-1 form

Page 2 of your Schedule E: If only one business is reported on your Schedule E.

Calculation for Partnership/LLC or S-Corporation (Filed as individual, 1 business)

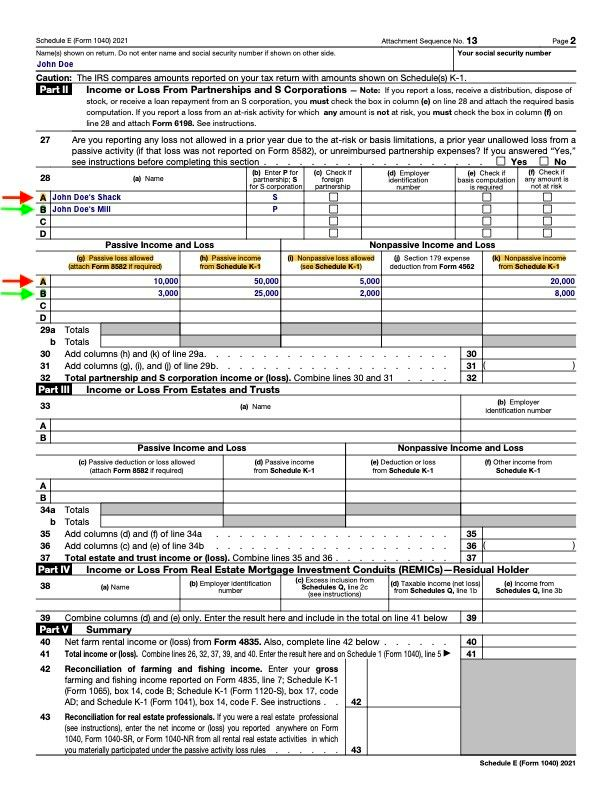

If you report more than one business you will look for your business on your schedule E (Box 28, A-D) and calculate each individual business income.

If you report more than one business you will look for your business on your schedule E (Box 28, A-D) and calculate each individual business income.

Calculation for Partnership/LLC or S-Corporation (Filed as individual, more than 1 business)

Schedule K-1

If your Schedule E is jointly filed, we must receive your Schedule K-1 to verify what of this income belongs to you.

Depending the incorporation status of your business, we would either be receiving:

-

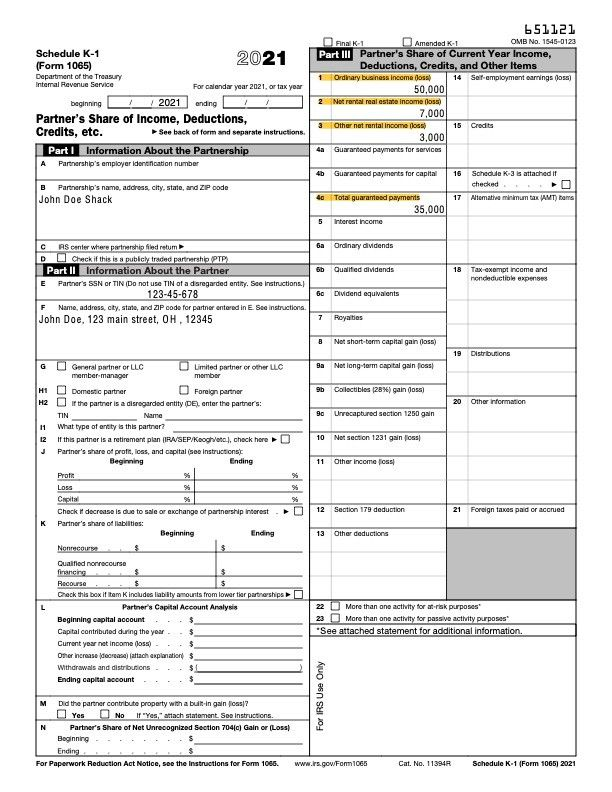

Schedule K-1 from Form 1065

- Calculation for Partnership/LLC or S-Corporation (Filed jointly: scenario 1)

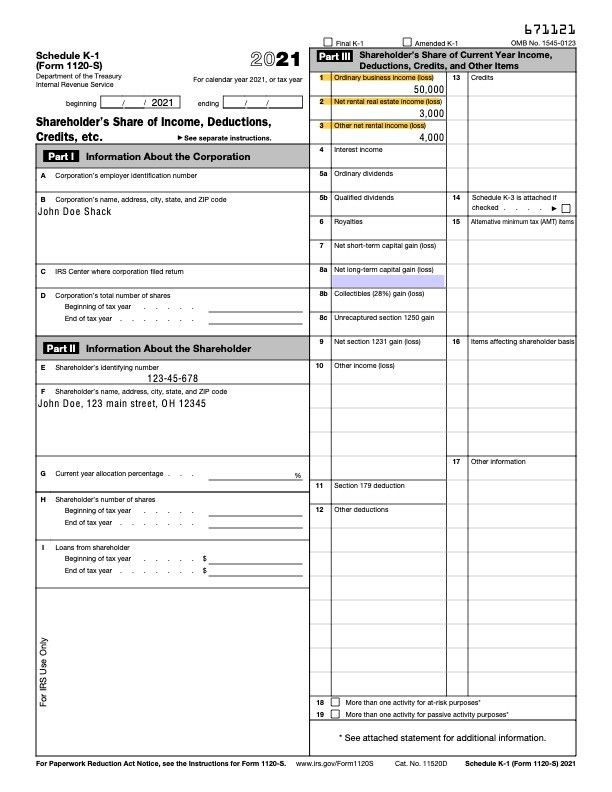

- Schedule K-1 from Form 1120-S

- Calculation for Partnership/LLC or S-Corporation (Filed jointly: scenario 2)

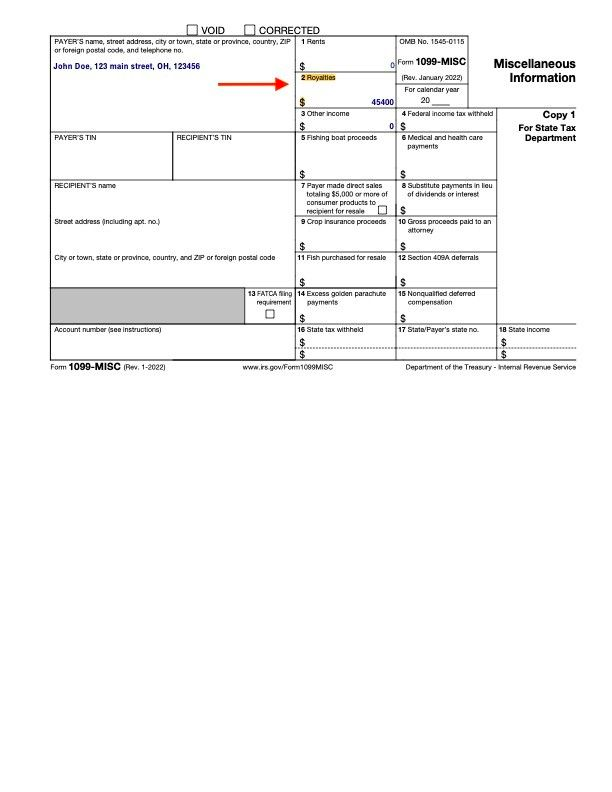

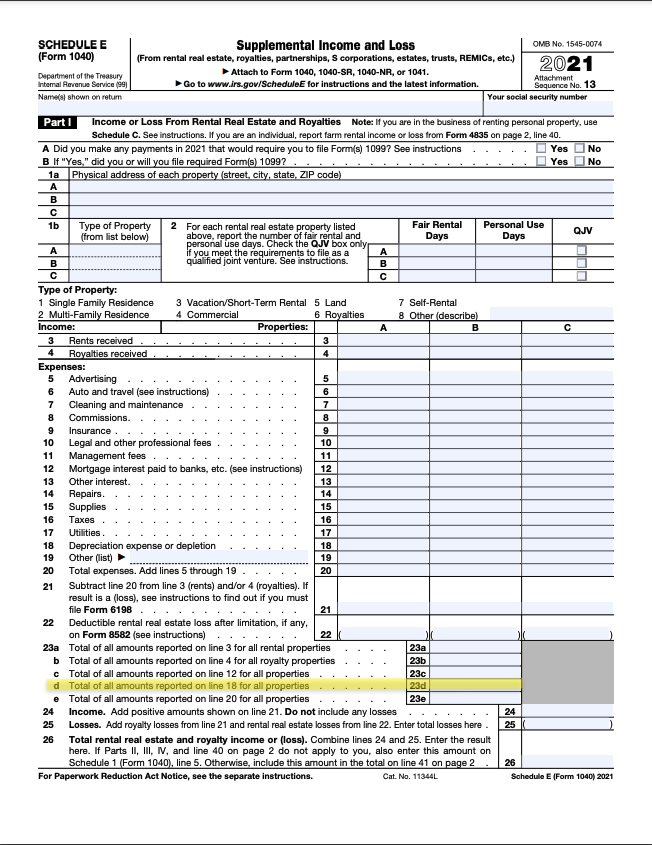

Rental or Royalty Income

Upstart recognizes any rental or royalty income by verifying your net profit or loss plus adding any depletion and depreciation.

Schedule E

- Calculation for Rental or Royalty Income (filed individually)

Jointly Filed Schedule E (Royalty Income)

Calculation for Rental or Royalty Income (filed jointly)